Easy Street Property Investments Davenport

How to Invest in the Business Down the Street

Here's how to help your local businesses thrive.

It's no secret that the key to building wealth is investing. Using your cash to support the growth of businesses not only helps you keep it growing and compounding for your future, but you're providing entrepreneurs and business owners with capital to turn their ideas into thriving enterprises that can boost economic growth.

However, for a lot of you, simply investing in major corporations can feel somewhat impersonal. You would much rather put your money to work nearby where you can see and feel the impact, investing in entrepreneurs and businesses from within your community rather than faceless corporations hundreds or even thousands of miles away. The good news is that — thanks in part to the 2012 JOBS Act — there's never been more ways for you to do your part.

Click through to see the best and worst cities in America to start a small business.

Shop Locally

One of the easiest ways to invest local is just to make sure you're buying as much as possible from businesses in your area. The financial returns are going to be indirect at best, but it's worth noting that the stronger the local economy, the higher the value of your home is likely to be.

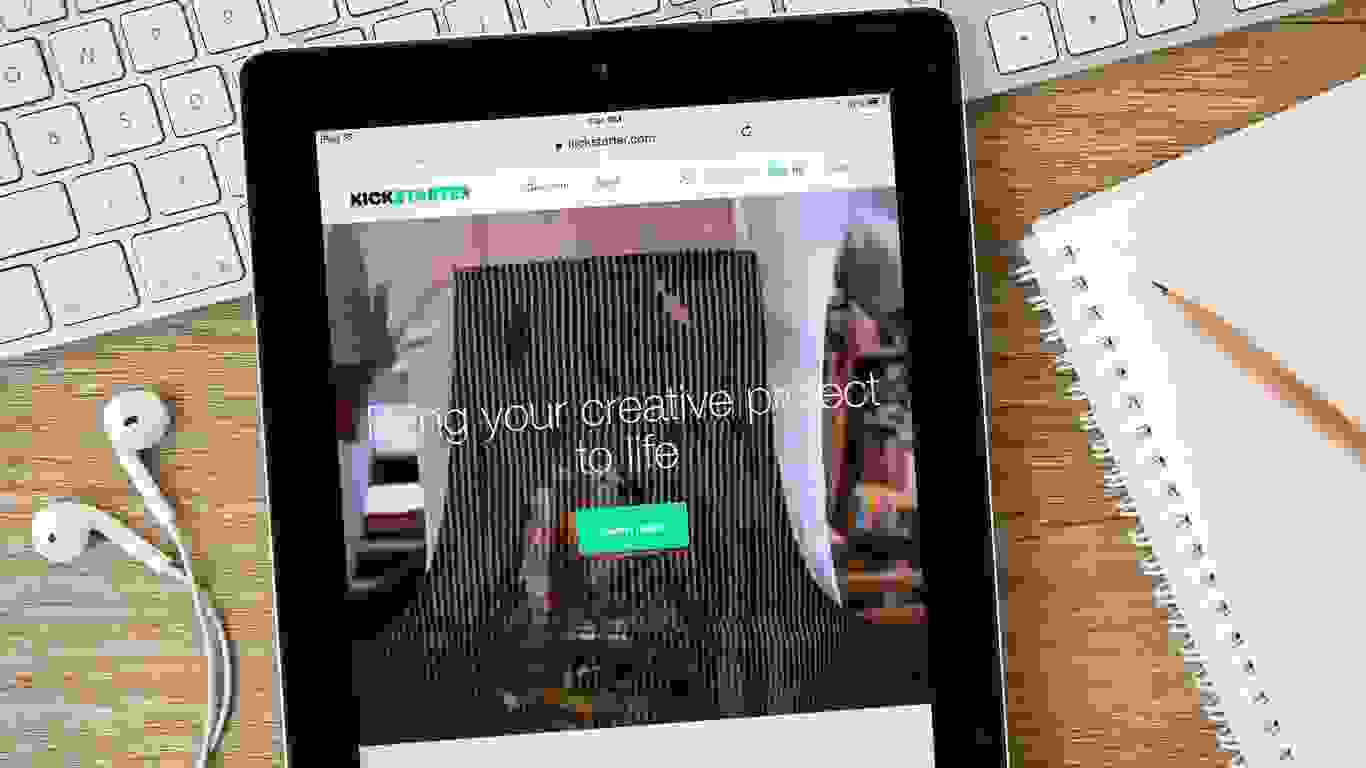

Rewards Crowdfunding

Many businesses have taken to relying on rewards crowdfunding platforms like Kickstarter, Indiegogo or GoFundMe to raise money for expansions or unexpected repairs. You won't be getting a direct financial return, but you will usually be able to secure goods or services in exchange for your donation, and you can play a crucial role in supporting a business in need.

P2P Loans

Even though peer-to-peer lending isn't a new concept, a new crop of companies using modern technology is connecting people in need of capital with potential lenders in a way that has never been possible before. Look at sites like Upstart, Lending Club, Prosper and others to find people or businesses in your community in need of a loan. They'll get the cash they need and you'll make interest on your money.

Angel Investing

"Angel investors" are the front line of capital markets, seeking out companies in their earliest stages of growth and helping them connect the dots in terms of the cash they need to grow. If you're an accredited investor, being an angel investor is an excellent way to roll the dice on entrepreneurs near home. The risks are very high — there's a real chance you will never see any of that money again — but you're supporting a potentially lucrative business at a crucial time in its growth.

See: 15 Stocks for Beginners to Try in 2018

Private Equity

Like angel investing, you must be an accredited investor to invest in private equity markets, but if you are you can buy shares in companies that haven't gone public yet on secondary markets. Once again, the risks are far higher than they are with any publicly traded company (hence the limitation on who can invest), but the potential returns on private equity investments can be enormous. Expect to be wrong a lot more often than you're right, but you just need one major success to reap huge rewards.

Equity Crowdfunding

Until the JOBS Act, it was illegal for companies using crowdfunding platforms to sell a stake in their future in exchange for cash. Now, there are limited opportunities for companies to raise cash directly from the public and give them a piece of the company's future in the process. What's more, while it's heavily regulated, the rules dictating crowdfunding specifically from within your state are much looser, making it a strong option for some.

Check out equity crowdfunding platforms that gather together opportunities in a single, browsable website and look for people from your area raising money.

Start a Blog

Sometimes the biggest barrier to building a business is awareness. If you have a lot of interest or knowledge about the local economy, consider starting a blog to help get exposure for vendors and businesses in the area. You can give them the attention they need to get their product out there and even help publicize investment opportunities to your friends and neighbors.

Ask Around

If you're exploring the options on various P2P lending and crowdfunding sites and not finding many options, you might consider just asking the owners of nearby businesses about potential investment opportunities. It's entirely possible that they've been frustrated by an inability to get the cash they need from the bank and could be interested in exploring their options with an interested party. You never know until you ask.

Investing 101: Answers to the Questions You're Embarrassed to Ask

Ask for Equity as Payment

If you're a contractor or business professional, you might begin by offering your services to nearby businesses in exchange for equity or some other form of investment rather than just accepting direct payment. For cash-strapped small businesses, an accountant or contractor willing to do their books or repair their pipes in exchange for a slice of future profits could be a godsend. Not every business is set up to take on an investor like that, but if they are, you could find yourself building a solid partnership with a business owner you already know well.

Get Started: 10 Apps for First-Time Investors

Join a Local Credit Union

Credit unions are nonprofit institutions set up to service a specific community or group. As such, their lending activity is almost exclusively going to be local to the area they're in. If there's a credit union nearby that you can join, simply doing your banking there is one way to help inject money into the local economy.

Found a Credit Union

Of course, if there isn't a credit union in your area, you might consider remedying that fact by founding a new one. This is obviously not a simple step to take and it's almost certainly not something you would be able to do on your own, but if you're really interested in taking the plunge, contact the National Credit Union Administration to get more information.

Form a Local Investing Club

One rather large step back from founding a bank would be to just put together a local investing club. You can meet with other interested investors in your community, discuss opportunities and even occasionally pool money to make a better offer. Not only will this help the local business community stay in touch, but it will give you a network of like-minded individuals to share knowledge with.

Start an Investment Fund

Similar to the investing club, putting together a legally recognized investment fund can help you pool expertise and resources to get the best returns for your money while also building a prospectus that is focused on local investing. Friends and family interested in supporting local businesses with investments but not interested in doing all the necessary legwork can simply invest in your fund and let you and your partners find and invest in worthy entrepreneurs and businesses.

Roth vs. Traditional IRA: Which Retirement Plan Is Best for Me?

Work With the Local Chamber of Commerce

Fortunately, the importance of building small business to local economies isn't lost on most people. That's why many towns or regions will already have a Chamber of Commerce committed to building an atmosphere that will foster growth. Check in with your local Chamber of Commerce about how you can help or what investment opportunities might be out there. And if there isn't one, consider starting your own with help from the U.S. Chamber of Commerce.

Start a Festival

About the Author

Source: https://www.gobankingrates.com/money/business/how-to-invest-in-local-business/

0 Response to "Easy Street Property Investments Davenport"

Post a Comment